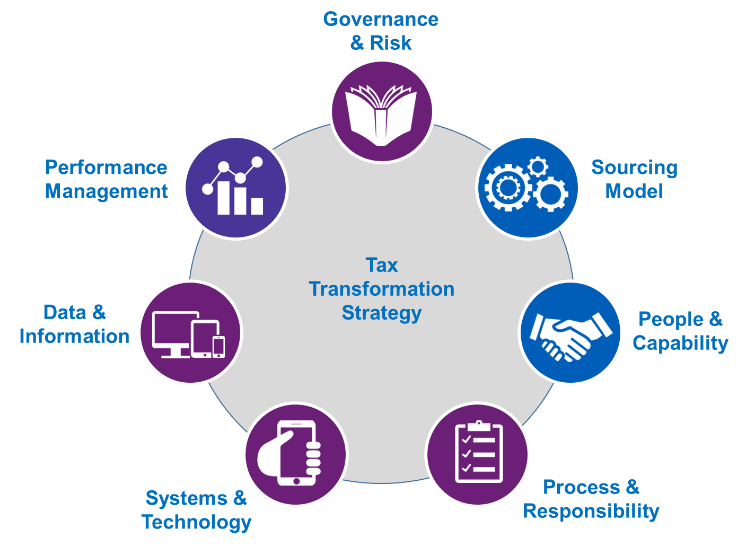

To future-proof your tax function you want to ensure that you adapt to external changes in the tax landscape, such as global tax reform and the digital economy, and embrace the latest technologies so that you make the best use of your time and maximize insights into/value from data and processes to improve your overall operations. This gives rises to a tax transformation strategy or journey, which is the process of transforming a traditional, rather manually-oriented tax function to a data-driven, digitally-enabled tax function, aligned with your overall (global) tax strategy.

There are several aspects – beyond technology – that are important to take into consideration as part of your tax transformation journey. For example, governance and risk, sourcing models, people/capability, processes and data/information.

But how do you start such a tax transformation journey? What is the role of technology and how do you ensure this is aligned with broader (financial) transformation initiatives and your overall IT/digital strategy?

What are the key challenges facing organizations?

Developing a tax technology strategy and roadmap should be part of your overall tax transformation strategy, which comes with some key business challenges:

- Addressing immediate needs through quick gains versus long-term goals.

How can you find these quick and easy solutions in order to generate a healthy interest in further expansion? - How can you develop a business case for tax technology deployments to drive the transformation?

- What do you need to consider when deciding whether to buy, build or collaborate?

- How do you ensure that the capabilities in the tax function are fit for the future? Where do you find the right resources?

- How do you define and implement a tax data strategy?

How can we help?

There are many ways in which our specialists can help you start your tax transformation journey, for example:

- Building a business case for tax technology and helping to design a tax transformation roadmap. Where are you now, what are your ambitions and what practical solutions are available to get there?

- Using a tax function benchmark to make recommendations on what a future tax operating model should look like

- A tax process assessment to identify opportunities for improvement using technology and data. Highlighting quick wins, long-term solutions and providing a strategic tax direction on how to kick-start an improvement program

- Develop a tax data strategy and identify ways to capitalize the value of data

- Help train your personnel to develop and enhance the skills required to use and adopt technology within the tax function

- Help to define technology/IT opportunities within your tax compliance processes.

More information?

If you would like to know more about your tax transformation strategy or if you have questions of a more general nature, please contact our specialists. They will be pleased to provide you with further information or advice.